|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Credit Score to Refinance Home: A Complete Beginner’s GuideRefinancing your home can be a strategic move to lower your interest rate, reduce monthly payments, or alter the loan term. One crucial factor in determining the success of refinancing is your credit score. But what is the best credit score to refinance your home? Let's explore. Understanding Credit ScoresCredit scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders use these scores to assess the risk of lending money to borrowers. What is Considered a Good Credit Score?Typically, a credit score of 700 or above is considered good, while a score of 750 or higher is excellent. A good credit score often results in more favorable loan terms. The Ideal Credit Score for RefinancingWhile you can refinance with a lower credit score, having a score of at least 620 is generally recommended for conventional loans. For the best rates and terms, aim for a score of 740 or higher.

Steps to Improve Your Credit ScoreImproving your credit score takes time and discipline. Here are some strategies:

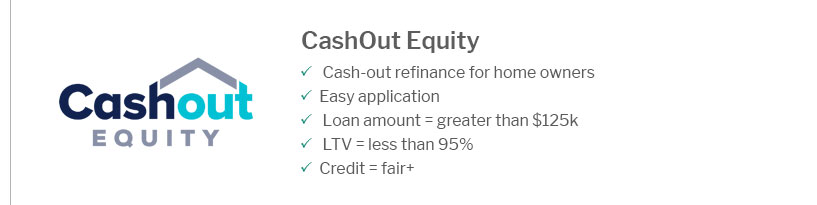

Even if you're currently unemployed, exploring options to refinance while unemployed might offer temporary relief, but improving your credit score remains crucial. Choosing the Right LenderOnce you've improved your credit score, selecting the right lender is essential. Research and compare different lenders to find the best lender to refinance home loan options that fit your needs. FAQWhat credit score is needed to refinance a home?A minimum score of 620 is typically required for conventional loans, though better terms are available for scores of 740 and above. How can I improve my credit score before refinancing?To improve your credit score, pay your bills on time, reduce your debt, avoid new credit inquiries, and regularly check your credit report for inaccuracies. Can I refinance my home if I am unemployed?Yes, it is possible to refinance while unemployed, but it may require a co-signer or proof of sufficient assets or alternative income. https://www.foxbusiness.com/personal-finance/credit-score-to-refinance-mortgage.amp

What credit score do I need to refinance a home? - Conventional mortgage loan (including cash-out and rate-and-term): 620 to 720 - FHA loan ( ... https://www.credible.com/mortgage/credit-score-needed-to-refinance-house

A rate-and-term refinance for a conventional mortgage loan typically requires at least a 620 credit score that is, as long as your loan-to-value ratio is 75% ... https://www.miamiherald.com/banks/mortgage-refinance/credit-score-refinance-home/

FHA Simple, Cash-Out and 203(k) Refinances require a credit score of just 580. There's also the FHA Streamline Refinance that doesn't come with ...

|

|---|